Tax Day was Tuesday, and, like it or not, it gets everyone, including social sector organizations, thinking deeply about finances. With the economic downturn and inflation, I spoke with one of our long-term partners, John Gillespie of Charles River CFO, about these issues and how to best tackle them strategically. We had a great conversation that resulted in today’s blog.

Tax Day was Tuesday, and, like it or not, it gets everyone, including social sector organizations, thinking deeply about finances. With the economic downturn and inflation, I spoke with one of our long-term partners, John Gillespie of Charles River CFO, about these issues and how to best tackle them strategically. We had a great conversation that resulted in today’s blog.

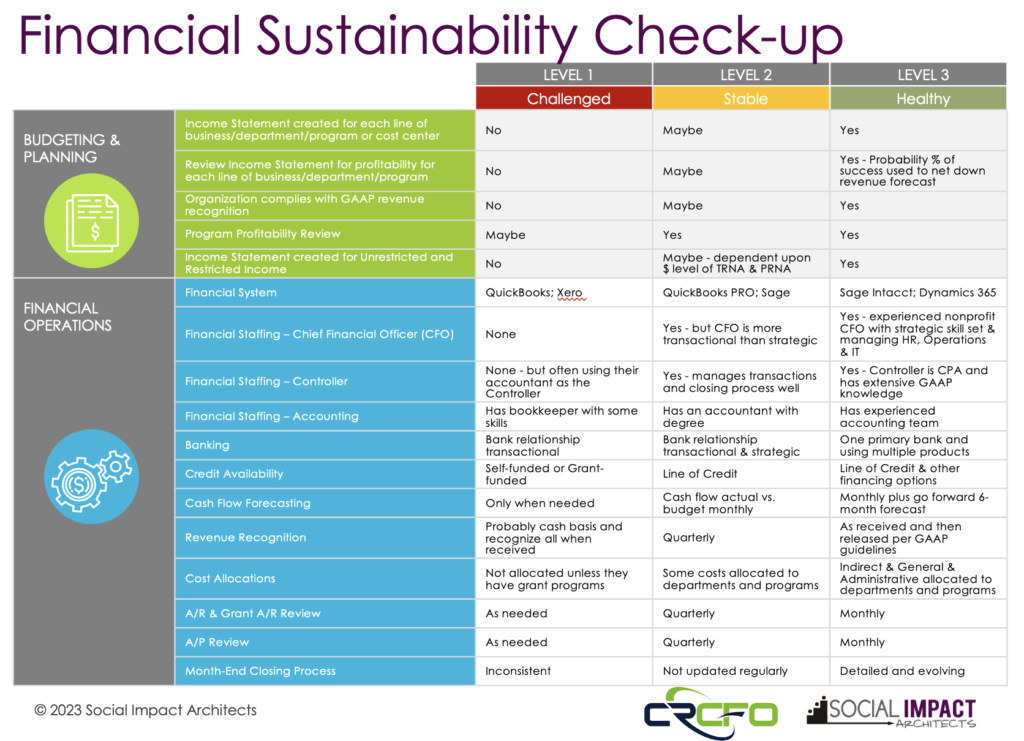

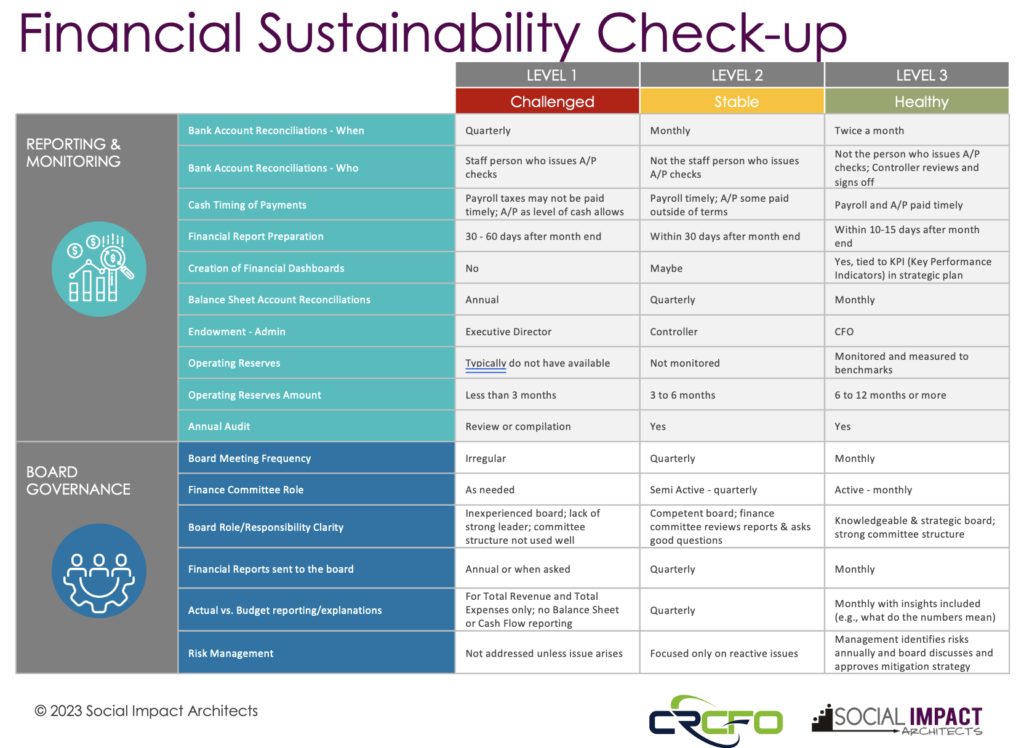

Collectively, we have worked with 500 organizations in the social sector. Every day society asks more of nonprofits, but they are often constrained by their existing resources. Society asks them to be “sustainable” but stops short of defining sustainability or giving CEOs and boards the tools to decipher where they are and how they compare to other organizations. Both Social Impact Architects and Charles River CFO share the same belief – we need to make it easy for nonprofits to do their jobs. With that in mind, we developed a comprehensive tool for staff (e.g., CFOs, CEOs) and board members (e.g., finance and governance chairs) to diagnose the health of their organization’s financial management. We encourage the board and management team to review the matrix based on their stage within the lifecycle and evaluate progress as a financial check-up for the organization. Then, develop a list of priorities and an action plan for each area.

As with any check-up, social sector organizations have major systems that need to be tested and sometimes recalibrated:

Budgeting & Planning

Your strategic plan guides your organization. Taking the time to build a detailed, bottom-up budget forces you to think through operational and programmatic issues. Translating the strategic plan or annual plan through financial pro forma into a budget translates ideas into a common economic language that clarifies where you are and where you want to be. Done correctly, it creates an economic roadmap to show you what you need to accomplish to reach your destination and allow you to recalibrate if you get detoured.

Financial Operations

Timely and accurate financial management lets you keep a pulse on revenue and expenses. The confidence in those numbers being right gives you the ability to make financial impact decisions when needed (e.g., can we afford that new staff person; can we spend more money on marketing, etc.)

Reporting & Monitoring

Department income statements and budget-vs-actual reports let you measure how the organization is doing. By assembling this information into dashboards and reviewing at least monthly, it puts these numbers into perspective, which allows you to make mid-course corrections as needed.

Board Governance

The board is your partner, and the board treasurer and your finance/audit committee members are your economic advisors. You’re both rowing in the same boat, headed in the same direction … forward. Partners have frequent and ongoing communication, find ways to leverage one another’s skill sets, share financial information and jointly manage risk.

click for complete Financial Sustainability Check-up

As we often say to our clients, “Without money, there is no mission. This is why the financial health of your organization is one of the most important areas to monitor and adjust when circumstances change.” We hope this tool provokes real conversations within nonprofits about how to build healthier organizations that can rise to the challenge of creating sustainable social impact. If you have specific questions, we would love to hear from you.