Like many of you, I grew up watching Oprah – both the “Oprah Winfrey Show” and now “Super Soul Sundays.” Oprah just has a way of connecting with both her guests and her audience to find out the “truth” behind any topic. While the job of a talk show host may seem far removed from our nonprofit roles, we can learn from Oprah’s natural way of connecting with people to glean information from an audience. In this post, we wanted to share our tips and tricks to channel your inner Oprah to conduct your own primary research.

Like many of you, I grew up watching Oprah – both the “Oprah Winfrey Show” and now “Super Soul Sundays.” Oprah just has a way of connecting with both her guests and her audience to find out the “truth” behind any topic. While the job of a talk show host may seem far removed from our nonprofit roles, we can learn from Oprah’s natural way of connecting with people to glean information from an audience. In this post, we wanted to share our tips and tricks to channel your inner Oprah to conduct your own primary research.

Before you begin your primary research, create a list of research questions (through backward market research or another method) and exhaust secondary sources. Take stock of what information you still need and devise a plan to reach out to the source or experts via primary research.

Primary research is the process of gathering original information. You can use many tools to collect this information, including observation, surveys, interviews or focus groups. Because primary research is often interactive, it requires you to take on the persona of a skilled talk show host in order to get the results you need. Like Oprah, you need to persuade your participants to share information by establishing a connection, speaking their language and staying neutral.

You also need to select the tool that will best help you achieve your research goals. People often jump quickly to a survey, but there is a wider range of tools available to get to the truth behind your questions. The following guidelines provide the background you need to select and use popular primary research tools. Keep in mind that each serves a different purpose and should be used accordingly. They are:

Talk show hosts occasionally employ audience polls to gauge the temperature of the room on hot topics. Similarly, surveys are great for discovering information about your constituents’ attitudes or attributes. They are inexpensive, and to get the best results, organizations should start with a representative group of participants and use plain language in the survey. You can use tools such as Survey Monkey or texting to get a quick response. For the best results, incentives are also very helpful in increasing response rates. If you want to keep track of clients, use an annual event or an online birthday card to ensure you have updated contact information. Many nonprofits use surveys as their go-to information source. While surveys can be revealing, they are typically much more effective when used in combination with other tools like interviews and focus groups.

Like talk show one-on-ones, interviews are the perfect tool when you need a specialized depth of knowledge. They can be time-consuming, so starting with the end in mind is important to get the information you need. For the best results, develop a list of questions (e.g., an interview protocol) in advance, starting with easy questions first, and choose an interviewer who can quickly establish rapport with participants. Be sure that the interviewees know that their answers are confidential. When compiling results, use a research process, such as grounded theory, to develop themes.

Focus groups are helpful when you want to gain insight on others’ attitudes, understand group dynamics or test responses to new products or services. In many ways, it is similar to when a talk show host interviews the entire cast of a television show – the audience has a glimpse of how the cast members work together and feel about each other. For the best results, select homogenous groups and use a moderator who can make them feel comfortable and elicit responses from as many participants as possible. We often pair a focus group with a quick entry or exit survey (depending on what we need to measure) to get additional information from all participants. It’s important to note, though, that because focus groups are small by nature, the responses that come from them are not statistically relevant and may not yield conclusive results.

Talk show hosts often speak with politicians after events like natural disasters or policy rollouts to discuss how they succeeded or failed the public. These are similar to debriefings, called after-action reviews, utilized in the military. These are useful in improving processes for ongoing activities at your organization to prevent missteps in the future. For the best results, the full support of leadership is needed to maximize the impact of after-action reviews and put staff feedback in motion quickly after the debrief.

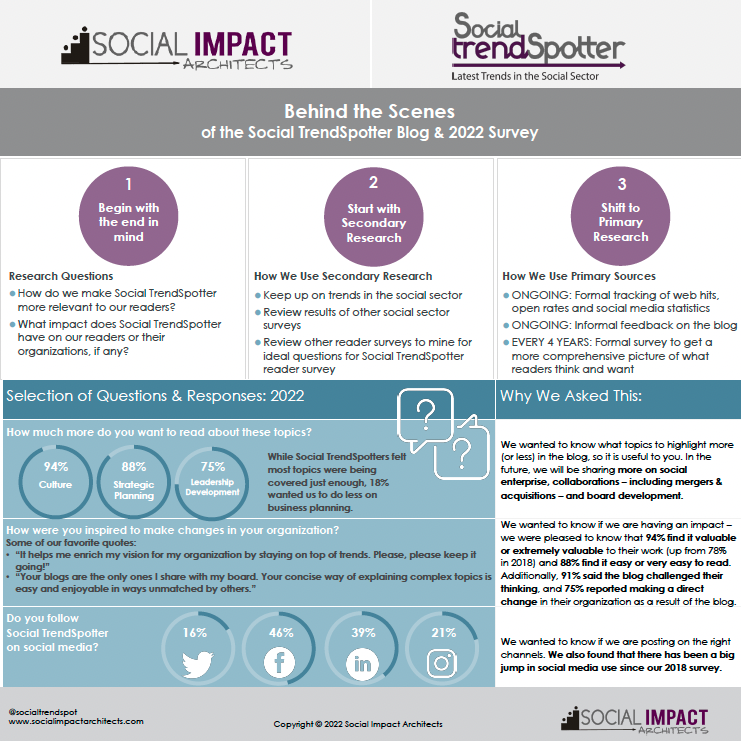

Finally, we wanted to give you a behind-the-scenes look at the entire market research process by sharing the results of the recent Social TrendSpotter reader survey. Our goal was to make Social TrendSpotter more relevant to you and determine whether our posts are making a difference. Take a look at the graphic below to see how we conduct our research – hopefully, it will inspire your own and help you develop a process that works for you!

We are always on the lookout for tips on how the social sector can best use primary research tools to become more impactful. If you have any, we would love to hear about them.

I do not even know how I finished up right here, but I believed this submit was great. I do not understand who you’re however certainly you are going to a famous blogger if you are not already. Cheers!