Everything changed two years ago – so much so, many futurists, including myself, shifted gears from long-range planning to week-to-week survival. Now, as the country begins to get back to “normal,” we have begun shifting back to long-term planning. For nonprofits, the past two years were the ultimate stress test. However, the next two years present opportunities for organizations across the entire social sector – to reinvent our missions, recalibrate our work culture and reinforce our systems. More change lies ahead, including inflation, increased competition from for-profit entities and a possible recession. Taken together, this provides fertile ground for conversations around nonprofit consolidation – whether it be through a merger, acquisition or an exit. I am honored to present on this pressing topic this week alongside Andrew Clearfield, JD, of Fizer, Beck, Webster, Bentley & Scroggins, at the State Bar of Texas Conference: 20th Annual Governance of Nonprofit Organizations. Our collective slides are here. Below we cover some key questions about mergers, acquisitions and exits:

Everything changed two years ago – so much so, many futurists, including myself, shifted gears from long-range planning to week-to-week survival. Now, as the country begins to get back to “normal,” we have begun shifting back to long-term planning. For nonprofits, the past two years were the ultimate stress test. However, the next two years present opportunities for organizations across the entire social sector – to reinvent our missions, recalibrate our work culture and reinforce our systems. More change lies ahead, including inflation, increased competition from for-profit entities and a possible recession. Taken together, this provides fertile ground for conversations around nonprofit consolidation – whether it be through a merger, acquisition or an exit. I am honored to present on this pressing topic this week alongside Andrew Clearfield, JD, of Fizer, Beck, Webster, Bentley & Scroggins, at the State Bar of Texas Conference: 20th Annual Governance of Nonprofit Organizations. Our collective slides are here. Below we cover some key questions about mergers, acquisitions and exits:

Is nonprofit consolidation on the horizon? What should nonprofits consider?

During strategy planning, every nonprofit should consider the question: should our organization continue to exist? Exercises such as external community surveys and internal strategic discussions can help nonprofits

break down this question and ensure the board and staff are aligned on the following:

- What the community needs – why an issue exists & persists

- What the organization wants to accomplish – its vision for the future as well as its mission and its unique value to the community

- What strategic challenges the organization and industry are facing – what is or could hold the organization back from delivering on the mission

As leaders evaluate their strategic options, it is critical to understand the ecosystem and the organization’s role within it. Some of these conditions are within the organization’s control, and others are not. This baseline understanding is the first step in considering whether a merger, acquisition or exit should be considered while all growth options are on the table during strategic planning efforts.

How do merger discussions start in the social sector? What makes them more or less successful? What is the difference between a merger, acquisition or exit in the nonprofit sector?

There are many similarities to merger and acquisition work (“M&A”) between the nonprofit and for-profit sectors. One notable difference, however, is that, unlike for-profit organizations, nonprofits work together regularly in the social sector to solve problems through a wide range of

collaborations (e.g., coalitions, shared services). As a result, M&A work can be a natural evolution of previous work together. It can stem from a need to combine territories to create a larger geographic footprint for greater return-on-investment. Or it can be sparked by a desire to combine services for a similar client or community need to create a more holistic solution (e.g., forward or backward integration).

Based on decades of research, the most successful M&A discussions resulting in stable organizations are natural outgrowths of existing collaborative work where nonprofits view each other as trusted partners. The least successful M&A discussions are forced, either by funder interest or a

crisis-driven situation when one organization needs the merger to survive.

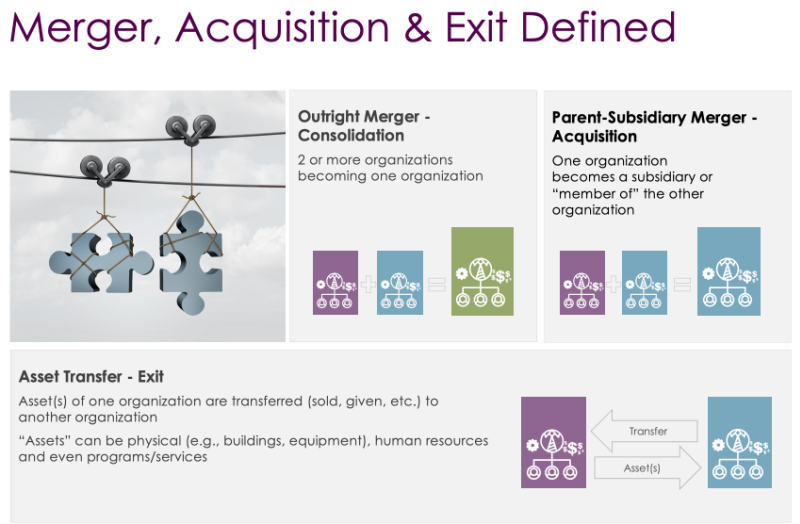

To that end, as nonprofits come together, they often start with the question: would we be stronger together? Then they move to the various M&A options for consideration, including:

- Outright merger (also known as Consolidation) – when two or more organizations bring great strength to the partnership, an outright merger is considered when the organizations are merged into one larger organization. Often, there is a detailed process where each organization is mined for their greatest strengths and a stronger hybrid is developed as the final nonprofit organization.

- Parent-Subsidiary Merger (also known as an Acquisition) – when one organization is more dominant (in territory and/or financial size) and acquires an existing nonprofit as a subsidiary to gain expertise and/or territory. Often, the dominant nonprofit drives this process and mines the subsidiary to build an overall stronger and more dominant position in the marketplace.

- Asset Transfer (also known as an Exit) – this happens in one of two ways: 1) a nonprofit organization (often through a strategic review) either decides a program/service/event is no longer needed or is no longer able to be supported strategically by the nonprofit. In these cases, if the program/service/event has value to the community, another social sector organization will take over its operation, or 2) sometimes through strategic review, an entire organization desires to exit and cease operations. In this case, the organization can exit on its own or try to find an existing nonprofit to take over some of its more valuable community work in exchange for assets, which could include physical assets and/or financial assets, such as government contracts.

What challenges can be expected during the M&A process? What are some of the benefits?

Similar to for-profits, nonprofits are started because there is a

void in the community and the founders genuinely believe their mission is needed. However, the different business models between nonprofits and for-profits change the dynamics of M&A. For-profits see visible proof of the need for M&A through improved financial performance. For leaders of for-profits, M&A is a rational next step, and an exit is often a desirable financial outcome for the founders or leaders. Nonprofits, on the other hand, have a double bottom line (financial and mission).

Founders or leaders are often reluctant to merge because they still believe the mission is needed; their solution is a unique approach to serving a community need; and they want to continue seeking financial support for that mission. Their decision is both rational and emotional, driven by the financials and the mission. Furthermore, because the loss of the organization (in whole or in part) is connected to the leader’s or founder’s legacy, the decision can become more emotional.

With this in mind, here are some common challenges:

- For Organization:

- Upfront time and cost for process, legal agreements & planning

- Overload from merging branding and processes into one future organization

- Uncertainty over contracts, donors and future financials

- For the Community & Client:

- Need for community meetings and public relations to gather input and ensure proper communication

- For Staff:

- Culture clash based on different values and norms

But, with all these challenges, there are also considerable benefits:

- For the Organization:

- Better strategic positioning

- Improved influence

- Increased financial stability

- Improved efficiency

- For the Community & Client:

- Streamlined client service delivery

- For Staff:

- Greater career opportunities

To mitigate the challenges above, we often recommend that nonprofits view the M&A process much like dating – with various stages of due diligence, trust-building and decision-making. By breaking up the process into these rational (and emotional) stages, it is often easier for nonprofit founders and leadership to make data-driven decisions based on the greater good.

If M&A is being considered, what is the best process to pursue?

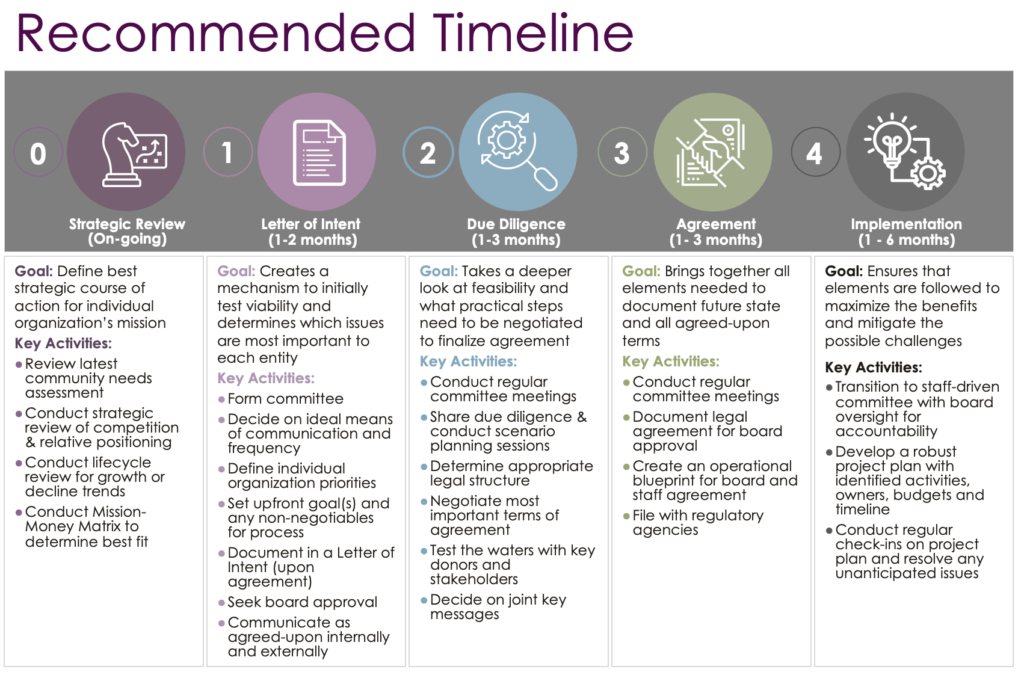

Mergers, acquisitions and exits take time. During the process, new information is often uncovered, causing it to take more time than expected. Using our dating analogy above, it makes sense. Sometimes partners meet, fall in love and partner quickly. Others meet as friends first and eventually become partners. Some individuals partner for a while before moving onto a formal arrangement. Some partner and then choose to not partner any longer. The same is true in a nonprofit M&A where there are many factors to consider – beyond economy of scale.

However, we do have a recommended process (see slide below) that can be customized based on timing, pre-existing relationship, and size and longevity of merging organizations.

What is the best time for legal counsel to engage in M&A conversations? Who else is needed?

Because M&A can be an emotional decision, sometimes it makes sense to engage an experienced nonprofit consultant (ideally an MBA with M&A experience) to kick off the first elements of each phase and bring an attorney into the process at key moments where legal agreements and expertise are needed (e.g., creation of Letter of Intent, filing with regulatory agencies). If the nonprofit has an attorney on the board, it might make sense for that individual to navigate the process until terms are established and an experienced M&A attorney is needed (e.g., Phase 3: Agreement).

Mergers and acquisitions take time and require careful planning, but if done correctly, they can bring a host of benefits to the organizations and communities involved. If you have been through a merger, acquisition or exit, we would love for you to share your thoughts with us. In the meantime, we hope you are enjoying the final days of the summer.

Everything changed two years ago – so much so, many futurists, including myself, shifted gears from long-range planning to week-to-week survival. Now, as the country begins to get back to “normal,” we have begun shifting back to long-term planning. For nonprofits, the past two years were the ultimate stress test. However, the next two years present opportunities for organizations across the entire social sector – to reinvent our missions, recalibrate our work culture and reinforce our systems. More change lies ahead, including inflation, increased competition from for-profit entities and a possible recession. Taken together, this provides fertile ground for conversations around nonprofit consolidation – whether it be through a merger, acquisition or an exit. I am honored to present on this pressing topic this week alongside Andrew Clearfield, JD, of Fizer, Beck, Webster, Bentley & Scroggins, at the State Bar of Texas Conference: 20th Annual Governance of Nonprofit Organizations. Our collective slides are here. Below we cover some key questions about mergers, acquisitions and exits:

Everything changed two years ago – so much so, many futurists, including myself, shifted gears from long-range planning to week-to-week survival. Now, as the country begins to get back to “normal,” we have begun shifting back to long-term planning. For nonprofits, the past two years were the ultimate stress test. However, the next two years present opportunities for organizations across the entire social sector – to reinvent our missions, recalibrate our work culture and reinforce our systems. More change lies ahead, including inflation, increased competition from for-profit entities and a possible recession. Taken together, this provides fertile ground for conversations around nonprofit consolidation – whether it be through a merger, acquisition or an exit. I am honored to present on this pressing topic this week alongside Andrew Clearfield, JD, of Fizer, Beck, Webster, Bentley & Scroggins, at the State Bar of Texas Conference: 20th Annual Governance of Nonprofit Organizations. Our collective slides are here. Below we cover some key questions about mergers, acquisitions and exits: